The Healthcare Revolution in 2014 is Not Just About Payment Models

Elizabeth Wingard

This is a fascinating time to be part of the healthcare industry. There is a revolution happening in how providers are looking at patients, looking at costs, looking at technologies, looking at…everything. The major driver of the revolution is, of course, changes to reimbursement models driven by the Accountable Care Act (ACA). The death knell is sounding loudly across the U.S. for the Fee-for-Service (FFS) payment model that the government and other payers have used to reimburse healthcare providers for decades.

In addition to the new payment models driving the healthcare revolution, there are other forces pushing healthcare to evolve. The development of new analytics and new technologies, a dwindling physician pool, and an aging patient population are change factors. So is a growing awareness of the disconnect between the amount of money spent on patient care and patient outcomes. Hospitals and physician practices all over the country are recognizing that more value needs to be extracted out of episodes of care for both patients and providers.

A Michael Porter report published in Harvard Business Review (HBR) last October entitled The Strategy That Will Fix Healthcare puts it this way:

“It’s time for a fundamentally new strategy. At its core is maximizing value for patients: that is, achieving the best outcomes at the lowest cost. We must move away from a supply-driven health care system organized around what physicians do and toward a patient-centered system organized around what patients need.”

Let’s look at 3 factors that, in addition to the key reimbursement changes, are driving fundamental changes in the healthcare industry.

#1 Analytics and Electronic Health Records (EHR)

The adoption of EHR and the availability of software that analyzes patient data are making it much easier for hospitals to create protocols based on large bodies of patient data.

Long-term studies of patient health records are providing beneficial insights into which procedures produce the best outcomes for an episode of care. What is being discovered is that reducing variations in care often results in lower costs, i.e. less hospital re-admissions, less rehab necessary, etc. States like Arkansas are also experimenting with bundled care models that provide a single payment for an episode of care that encourages cooperation and shared responsibility among all the healthcare providers to a patient for that particular episode of care.

The HBR report referenced earlier talks about pulling down the silos between healthcare providers so that the patient is at the center of a highly communicative team that shares responsibility for the outcome. This is a challenging model for hospital administrators who will need to incentivize doctors and other providers to work together in a more collaborative way.

#2 The Baby Boomer Factor

Baby boomers are retiring and putting a big bulge in the number of older patients who will likely need more care over the next several decades. Meantime, baby boomer doctors are retiring too and there are not enough doctors in the pipeline to take their place.

An increase in midlevel providers like nurse practitioners and physician assistants will likely continue over the next few years to round out the clinical care mix at hospitals and physician practices, driven by both a decrease in available physicians and by expected lower reimbursements from payers.

#3 Technology

Advances in technology have made it possible to support a move from FFS to a more diagnostically focused model enabled by Information Technology platforms. These platforms enable the delivery of better care across geographies and integrate care delivery across multiple facilities. Patients in remote areas are provided access to specialists and hospitals have a clinical revenue growth opportunity in a reimbursement-challenged environment.

A recent article in Forbes quotes research by industry analysts predicting telemedicine will jump from $240 million today to $1.9 billion in 2018 – an annual growth rate of 56 percent.

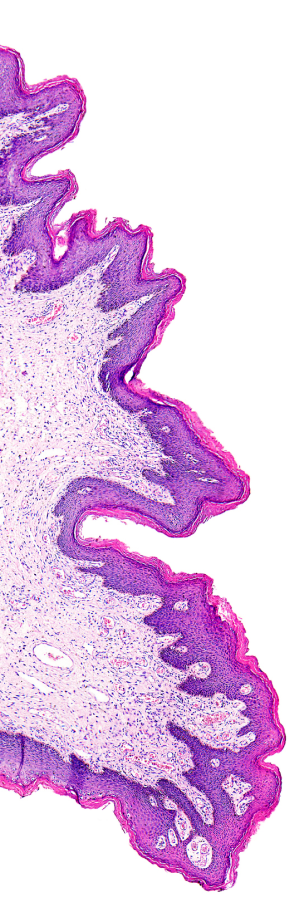

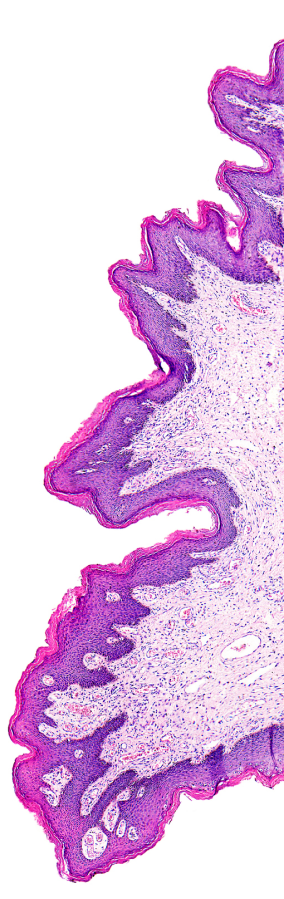

Telemedicine is proving itself in many arenas from pathology to diabetes. In the case of pathology it extends the reach of specialist pathologists to rural outposts, providing faster service and access to expert reviews. This access equals more value to both the patient and the healthcare providers: less unnecessary tests, procedures, and medicines.

Mayo Clinic is using telemedicine to treat stroke patients at remote facilities. Some healthcare providers are using telemedicine to track diabetes patients and spot red flags that get patients into the office sooner to forestall complications. Dartmouth Hitchcock’s recent USDA telemedicine grant will enable increased support for 38 remote communities and facilities in Northern New England, including telepathology.

The widespread adoption of smart phones in recent years has created opportunities for providers and payers to better educate consumers about behaviors that promote wellness and even stage video doctor visits.

These converging factors that are spurring the revolution in healthcare are fighting a headwind of the traditional FFS workplace culture. In order for real change to take place, hospitals must find a way to incentivize physicians and other providers to work collaboratively on episodes of care.